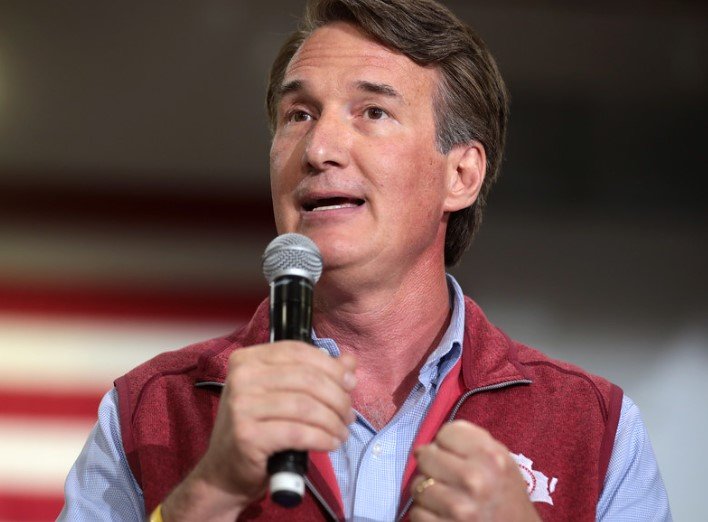

In a bold move, Virginia Governor Glenn Youngkin unveiled a new state budget aimed at both stabilizing revenues and allowing Virginians to retain more of their hard-earned money. The proposed budget spans the next two fiscal years and introduces significant changes to taxation.

Closing the Big-Tech Tax Loophole

Youngkin’s plan includes lowering income taxes while simultaneously raising the state’s sales tax. Notably, the sales tax will now encompass digital services, such as music downloads, which were previously untaxed. This move is described as “closing the big-tech tax loophole.”

Democratic Opposition and Criticism

While Youngkin’s proposals aim to attract more people and jobs to the state, some Democratic lawmakers have criticized the plan. They argue that it disproportionately favors the wealthy and shifts the burden onto low-income taxpayers. Sales taxes, often considered regressive, can impact those least able to afford them.

A Shift in Position

Interestingly, Youngkin’s stance on abolishing Virginia’s personal income tax has evolved. During his campaign, he expressed a desire to eliminate it entirely. However, since winning the GOP nomination, he now acknowledges the infeasibility of complete abolition. Instead, he focuses on cutting income taxes and providing additional relief to families and businesses.

The Road Ahead

As the General Assembly convenes in January, Youngkin’s budget proposal will undergo substantial changes. Democrats, who hold a majority, will have the opportunity to shape the final budget. Regardless of the outcome, the debate over taxation in Virginia continues.